Profit and loss are common terms for any business because business ideas start with how much a business will profit or lose over a specific period of time. Based on both these factors, you can decide how long you can linger on your business with the necessary resources, as a business needs to go beyond the break-even point to sustain itself economically. This is where you need to perform profit and loss analysis.

With the profit and loss statement (P&L), business owners may acknowledge how much cash they are left with to use for cash flow, how much they have spent over time, and how their businesses are performing over a course of time. With a profit in hand, the business can bring you hope to enjoy your benefits, whereas the loss can doom your entire project to failure.

Hence, having sufficient ongoing ideas about your business’s revenue and expenses can help you forecast your company’s financial performance. Therefore, you need to analyze your P&L statement on a regular basis. Let’s dig down to the core of the profit and loss concept and how they are analyzed with suitable factors.

What Is a Profit and Loss Statement?

A profit and loss statement is a statement detailing a business’s revenues, costs, and expenses within a particular, fiscal year, calculated monthly, quarterly, or annually. It is crucial for representing the financial health of a business. This indicates how much the business makes in that timeframe, and based on that, it states the performance of the business within that capacity.

P&L goes by various names like income statement, report card, revenue statement, earnings statement, or statement of financial performance and mainly focuses on the net profits, the bottom line of the statement. If the bottom line turns out well, it means your business is, above all risk of causing any financial impairment. It is called the black line.

But if the business makes losses over losses, and that’s projected in this statement, especially in the bottom line as the red line, it means now it’s time to wrap your business or find an alternative way to bypass the losses and take a stance to fast forward the business to a profitable direction.

Why Is It Important to Perform Profit and Loss Analysis?

Identify the Items Bringing You the Profits or Losses

By analyzing the P&L statement, you can be sure which items in your store or online e-Commerce are responsible for triggering a big jump in profit. By segmentalizing them, you can now have a clear idea about the items that are the bigger grosser, and you can now order more for your store rather than having unnecessary items that only increase your costs.

A P&L statement can have all these items broken down into subsections to give you a holistic view of the items creating the most sales, letting you eliminate the items you don’t want for their high maintenance costs or cost of the good sales price (COGS).

Understand and Interpret the Bottom Line

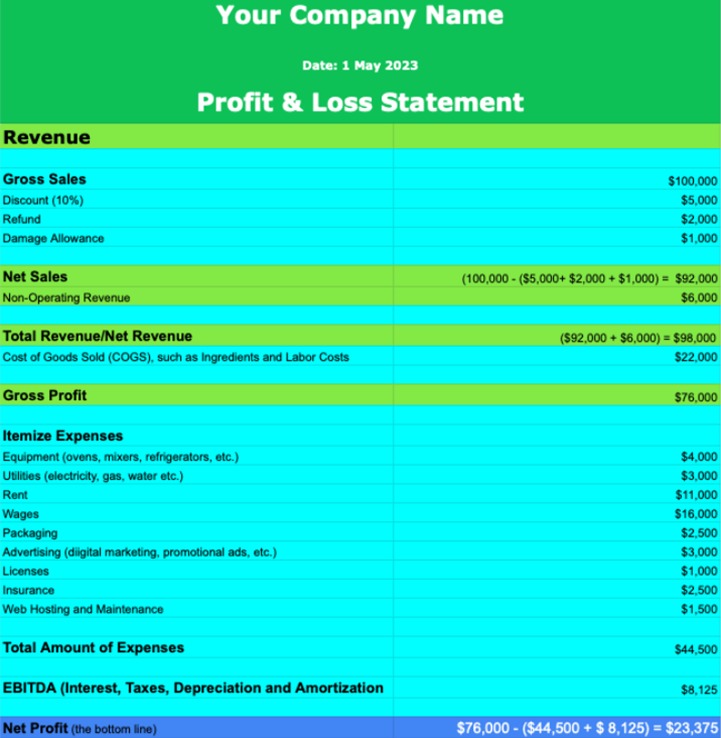

Look at the following profit and loss statement. We’ll analyze each of them later, but let’s look at the bottom line for now.

The bottom line indicates the last thing of the statement, which is the net profit – the important factor that hints you where your business is heading. It is called the bottom line because the net profit comes at the very bottom of the statement once all the revenues, costs, and expenses are deducted. It gives you a net profit from a gross profit, making it absolutely clear where your business performance stands.

Of course, a net profit with a high margin is a clear indication of your business’s success. But having a loss doesn’t always mean your business is at stake, especially when you start your business from scratch. Buying equipment for offices, paying advance for the office location, and giving salaries to your employees even before you start selling your products or services can incur losses to your business.

Therefore, you need to learn how to interpret your bottom line. If your bottom line is in the black, your earnings outnumber expenses, but the opposite is true when it is in the red.

Compare Year-to-Year for Predicting Upcoming Financial Year’s Projection

Continuing to invest more in resources and employees to expand your business depends on the overall money accrued in the years before the current year.

By comparing this year’s financial performance with the previous year’s apples-to-apples, you can gain an insight into the overall financial score of your business. When you try to interpret these figures for this year and last year in the form of percentage of change, this gives you a clear picture of the overall operation.

The math won’t always be simple, where having a bigger percentage in profit this year highlights that this year made more profit than last year. If your office expense soared than last year and that too more than the profit, that means the profit grossed this year is worse than last year due to the increased expenses this year.

How? Suppose your this year’s revenue has gone up by 25% from last year, but your office expense has gone up too by 70%, then there’s no valid reason to celebrate this success even though the profit margin may look humungous. That’s why you need to perform a profit and loss analysis that gives you a reason to scrutinize what went wrong with these figures or your company’s overall financial operation.

Steps in Performing Profit and Loss Analysis

Before analyzing the profit and loss statement, you just need to tell your bookkeeper whether your transactions are mostly accrual basis or cash basis. By the way – the reason you should approach a bookkeeper is because they are good at reading your transactions, discerning all the nitty gritty of the statements, analyzing your statement for drawing any conclusions, and projecting your economic situation of the finance.

Most businesses, these days, have adapted to accrual accounting from cash basis accounting as the businesses dealing with products or services are getting huge, and a surge in turnover makes it difficult for the businesses to have all the payments made or accepted by cash.

Cash basis accounting is about dealing with cash, where revenue is recognized when you make the earning upfront. In that sense, the expense is recognized when the vendor gets the payment upfront. On the contrary, accrual basis accounting refers to a system where the revenue will be counted once the payment is released to be transferred to you regardless of when you actually receive it. By the same token, expenses are recognized when the payment is sent to the vendor, regardless of when the vendor actually gets it.

Let’s go through the important steps you need to follow to perform profit and loss analysis. For reference, we are using the same sample of profit and loss statement given above.

Gather Your Financial Data

Before generating a P&L statement, you need to gather a curated copy of all the financial and transactional data. This can range from receipts, invoices, bank statements to photocopies of credit or debit card payments, and printed copies of online payments like Stripe or PayPal.

Remember, a fully-fledged business doesn’t only run on card payment, it can also run on credit, debit, online payment, and many more. When you pay any money to your vendor, there should be proof of that payment in the form of a receipt.

Also, as a business owner, you may physically keep some cash in hand to reimburse your employees for their transportation costs related to your business activities. This is called petty cash, and you need proof to present it during the creation of the P&L statement.

You should also make a photocopy of the cheque for any payment made to the bank. All this recordkeeping will help you or your bookkeeper to generate an accurate profit and loss statement down the line.

Identify Your Revenue Sources

Any P&L starts with a first line called revenue. Revenue is the total amount of earnings that your company earns even before any sort of expenses or costs are cut or deducted. It primarily consists of net sales and non-operating income. The first thing that comes in revenue is the

Gross Sales: The total yet unadjusted amount a business earns through its operation prior to considering or applying any discounts, refunds, and damage allowance (if there is any).

Let’s say your bakery business has grossed $100,000 by directly selling its products to customers. It will be called gross sales, as no other expenses are deducted.

Net Sales/Net Income: This is the amount your business will be left with through its primary activities after those discounts, refunds, or allowances are taken into consideration.

If you applied a 10% discount on the overall gross sales of $100,000 ($5,000) on certain products along with $2,000 refund costs and $1,000 damage cost, it would be considered as net sales.

Non-Operating Revenue: This is the revenue generated from sources other than the business’s primary activities. These earnings come from sources like interest, renting out your excess area to another business, etc. In this case, let’s say your business has gathered $6,000 from both interest and renting out to a small alfresco selling coffee.

Net Revenue: Once the cost for refunds or allowances is deducted from the overall sales, this will lead to the net revenue, which is $98,000 in our example.

Calculate Your Cost of Goods Sold (COGS)

This is one of the important costs for any business as it determines how much is invested in making the product that you are selling and paying the wages to the labors who are directly involved in making the product, bakers in our cases. Therefore, the cost of goods sold refers to the costs directly related to the production of the product or goods.

Bear in mind that the labor cost here is not to be confused with the salary of the administrative staff. They could be in-house accountant, receptionist, or those who serve, manage and deal with the cash machines.

Calculate Your Gross Profit

This is the profit that your company makes after deducting all the costs associated directly with producing the bakery items but exclusive of any overhead costs like rent, salary, packaging, etc. In our case, after subtracting COGS ($22,000), the gross profit stood at $76,000.

Calculate Your Operating Expenses

These are the regular and usual costing that any business needs to operate spontaneously and smoothly. From our sample, you can easily detect which expenses are needed to keep your bakery business up and running with a flawless operational flow. Once they are summed up, the overall itemized expenses turn out to be $44,500. Once subtracted from the gross profit, it generates your operating income as $31,500.

Subtract Your EBITDA

EBITDA stands for earnings before interest, taxes, depreciation, and amortization and applies to those individuals who may have taken a loan against their income or experienced a depreciation like the resale price of the machinery. In our case, let’s say you have incurred a total of $8,125. This came from a reduction of the presale value of your bakery machines and licensing cost.

Analyze Your Net Profit Trends

Here comes the most important factor for which you have made all these efforts – net profit. To perform profit and loss analysis, you need to know the net profit because this will give you an indication of your profit margin. As mentioned earlier, having a positive figure in profit doesn’t imply that your business is always on the sprint.

When you compare this year’s turnover with last year’s, you can get a bird’s eye view of your company’s overall financial condition.

Final Thoughts

Profit and loss statement, balance sheet, and cash flow statement together lead your business in the right direction as it gives you a hint about the health of your business. It also tells you what to do to sustain or what not to do to save your very last investment. Therefore, you must perform profit and loss analysis to keep current with your business and make a foresighted decision based on the facts rather than any ad-hoc strategy with no clue at all.

Contact Oshawa Bookkeeping to get ahold of your profit and loss statement and take help to delve deeper into your financial acumen.