It is no further from the truth that the tax season can be intimidating for many for not sorting their paperwork properly, whereas, to many, it is a season to claim most of their tax deductions fairly with the right recordkeeping of their financial statements and cash flow management.

If there is, one thing you want to salvage from your office when it’s at a loss or to shut down is your precious accounting information so that you can make your expense tracking and necessary financial analysis for CRA compliance. Likewise, you need it equally at the time of your success. Hence, catching up on bookkeeping at the right time is all we need, and that’s what is delineated in this blog.

Step-by-Step Guide to Catching Up on Bookkeeping

You won’t realize how hard the entire process of recording necessary financial statements for small business bookkeeping is until you face it and then feel the necessity of hiring a bookkeeper to sort out the entire thing to spare you from such a tedious yet the most valuable task to save your asset. Take a look at the following process of catching up on bookkeeping –

Gather Necessary Documents and Information

1. Customer Invoices:

Invoicing and receipt management give you relief if you manage to store it; otherwise, it would be a pain in your back if you decided to forgo it. As a small business owner, you may have sold a lot of things in exchange for money to your customer, for which you had your invoices generated for the customers.

If you sold something on a cash basis, you might have recorded it in the form of an invoice, but on an accrual basis, you only recorded the amount the moment you sold something, not when you received the cash.

For example, if you sold $3000 worth of products or services to your customer on the 28th of April 2023, but the payment is to be received by the 30th of June 2023, then you would recognize its payment on the 28th of April on an accrual basis despite not getting the cash upfront. For the cash basis, you would immediately address its payment on the 28th of April.

Therefore, you must go over your customers’ accounts to find all the receipts and invoices for that tax year to get them sorted and saved in one centralized system, preferably accounting software, for instant and quicker access.

2. Debt Collections

The specific charge-off method involves writing off the bad debts that are deemed uncollectible for that tax year with a proviso that the business made its best effort to get in touch with the payers through phone, email, or mail. This way, the business can convince the CRA to return the deducted amount during the tax return.

Let’s say a customer owes $7,000 to your business but didn’t pay it. You have tried your level best to get that amount back but failed. In that case, you will write off that amount as bad debt and expect CRA not to claim tax on that amount.

Another way, namely, the non-accrual method, allows the business owners to put a halt to the accrue of the interest attached to the total debt amount that the customers owe and stop treating that amount as their income.

For example, your business gave a $10,000 loan to a customer and expected to receive $500 interest. Once it is deemed as bad debt, you can stop accruing interest from it and treating that interest amount as income amount unless obtained. In that case, your debt will not be considered extra income, and a tax deduction claim can be made on that uncollectible amount of $10,000 unless collected.

3. Business Expenses

Business expenses are one of the most indispensable tasks for tax preparation. Most often, owners tend to let their office expenses go unnoticed, and the tax is then applied in that amount, leading to a headache among the owners. You often forget that the amount you spent on your official accessories is also part of your tax deduction activities.

If you have bought furniture for your office, a substantial amount in office rent, and disbursed a miscellaneous amount in other activities like professional fees, they must be deducted from the gross income. Hence, your tax must only apply to the leftover net income. Besides, it also saves you from double taxation as well.

Therefore, collecting all the receipts and reviewing them one by one should be one of the foremost priorities. We are damn sure that you won’t like to swindle any excess money for unnecessary tax out of your pocket, will you?

4. Vendor Accounts

For better financial reporting that indicates what things need to change or be improved or amended to make a better profit margin to derail from any losses, you need solid and consolidated financial statements, including the profit and loss statements, most importantly, the vendor accounts’ receipts. Vendors are the individual or companies supplying goods or services to your companies.

Paying their bills in full for that financial year and recording and saving them in your database helps you make the most reinforced financial statement. This statement is important for that year because it highlights your business’s overall condition and the company’s financial health.

To create an accurate year-end statement, you must have all the copies of those paid bills in your possession. Even if it takes you to contact those vendors to send you a copy of those bills in case of not having them stored, you must rush your feet off to obtain them so that you can share them among your other stakeholders and investors at the time of need. It also proves that part of your income has gone for the payment of those vendors, saving you a lot of tax through a fair deduction.

Reconcile Bank Records

Bank Reconciliation helps you accomplish multiple objectives. It ensures that any business expenses you allocate for your investment are not missed. Also, you can identify any mismanagement or wrongdoing made by the bank by looking at their statements. Therefore, reconciling helps you match your business’ own accounting software’s stored financial statement with your bank’s statement to cross-check they match each other and don’t contradict.

Upon contradicting, you can find out what is missing from the bank statement or what is added to the bank statement that leads to the errors. Based on the findings, you can fix the error and reassure that both statements agree with each other this time.

Even by doing so, you are also updating your accounting database and creating expense categorization to ensure that it gets the up to date information regarding the financial health of the company because it can help to produce a graph or financial curve to show you the status of your finance in the form of data visualization.

Separate Personal and Business Expenses

This is one of the most common bookkeeping mistakes most small business owners make by not separating their corporation and personal account. But rather, by commingling the personal and business account, they lose their liability protection that would otherwise have shielded their liability from any negligence or loss. By doing so, the owners get directly liable for any debt or loss incurred due to a mix-up.

By commingling both accounts, the owner falls into the trap of piercing the corporate veil situation for which the owner has to take responsibility for the business’s debt and loss, whereas that was supposed to be covered by liability protection.

That’s why accountants or any foresighted bookkeepers will tell you to abstain from keeping both accounts merged. They want you to treat them as separate entities. Otherwise, what it does is keep you confused about where and when you spend your money.

For example, you may have received a sum of money from one of your personal friends, and that will be treated as income, whereas it’s not. Or, you may have taken your clients to a restaurant where you paid bills that should have appeared in your business account. Owing to having a merged account, you now may or will forget which one is for your business and which one is for yourself. It happens mostly when you have none of these receipts available or sorted or organized.

To make things easier, always collect and store your receipts in one place. There are many ways you can do it; you can scan those receipts and store them in Dropbox or Google Drive, or you can snap photos of you being at the restaurant treating a client to dinner. You can then forward those images to your business mail so that in the event of an audit, you can present all of them as samples of evidence.

To save your back, you should be catching up on bookkeeping either yourself or hiring a bookkeeper to get a myriad of effective advice.

Create Digital Records and Go Paperless

One of the easiest ways to claim tax returns is through showing your office equipment purchase. But investing in your unnecessary and unwanted items for the office may not be wiser either. When you document and compile everything on paper and store your receipts as paper, it requires enough space to be accommodated.

Also, using paper contributes to damaging your earth’s atmosphere by increasing carbon emissions. Hence, any extra carbon footprint during the time of manufacturing can be detrimental to this planet.

Also, getting these papers stored in the cabinet in the presence of new employees or unauthorized personnel can lead to more vulnerability to theft, loss, or nicking. It compromises security, which then leads to creating distrust among your customers or clients.

Going paperless and creating digital records for budgeting and payroll processing to financial forecasting help your company become digitalized too. Embracing digital records in creating digital receipts and invoices is a relief for your business, with little prospect of losing them or spending hefty for their security or purchase.

It reduces carbon footprint because less paper will be needed by a company like yours, requiring less manufacturing demand. You can also streamline your business operation by conserving all your papers in a data storage system like a Cloud system. Cloud accounting software will allow you to keep them all organized so you can access them anywhere in the world as long as you can keep your internet connectivity active.

You can reap the benefits of such automation tools like Shoeboxed for scanning your receipts and FileThis for snapping photographs of the receipts and storing them.

T4A Slip, Form W-9 & Form 1099-MISC: Form Submission for Independent Contractors

One of the few reasons to be catching up on bookkeeping is to send out the T4A slips, form W-9, and Form 1099-MISC, get them filled out by the specific individual, and send them back again to its governing body.

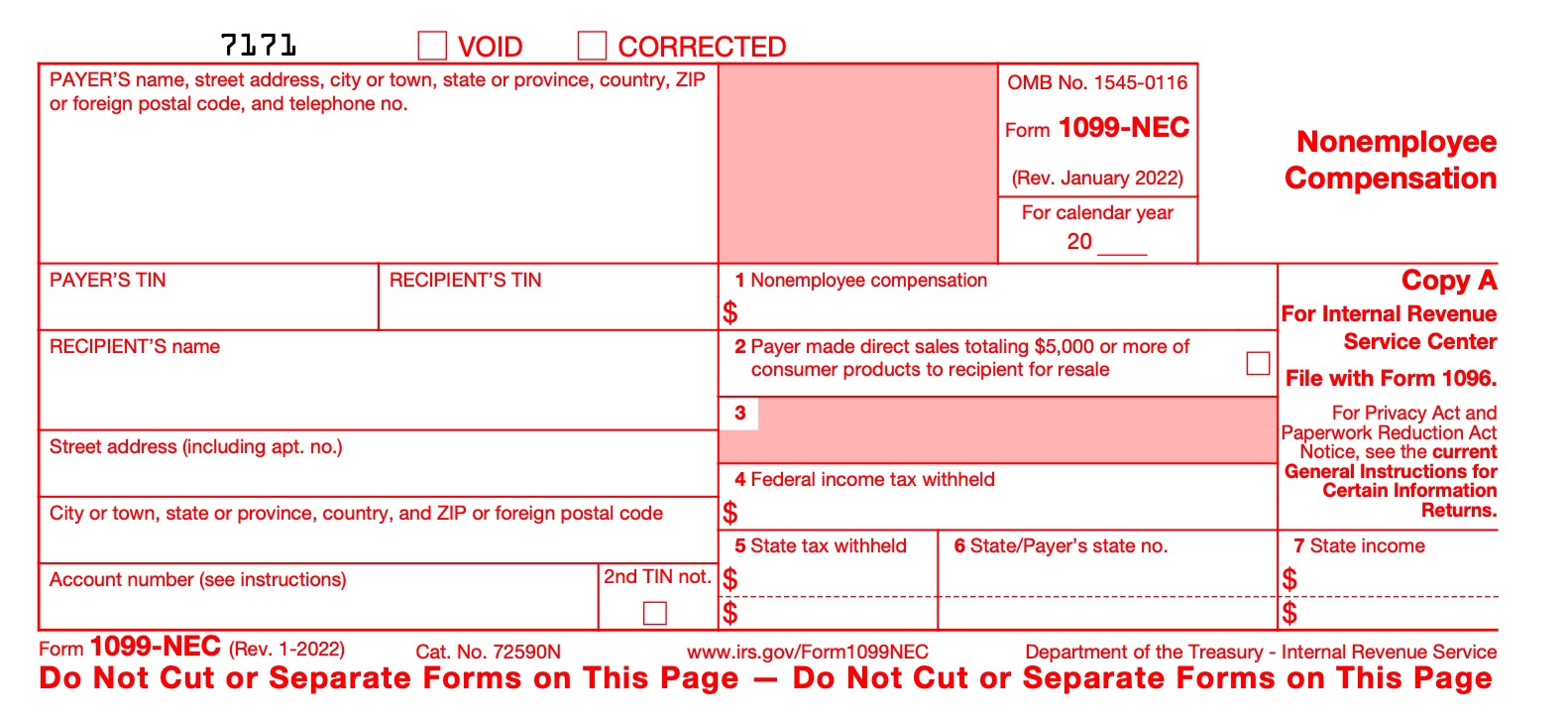

In the US, when a company works with an independent contractor whereby the company has to pay more than $600 that year, those contractors need to fill out the W-9 form. Upon their return, the business then has to complete the form 1099-MISC based on the information made on the W-9 form. This form is then sent to the IRS in the US.

1099-NEC

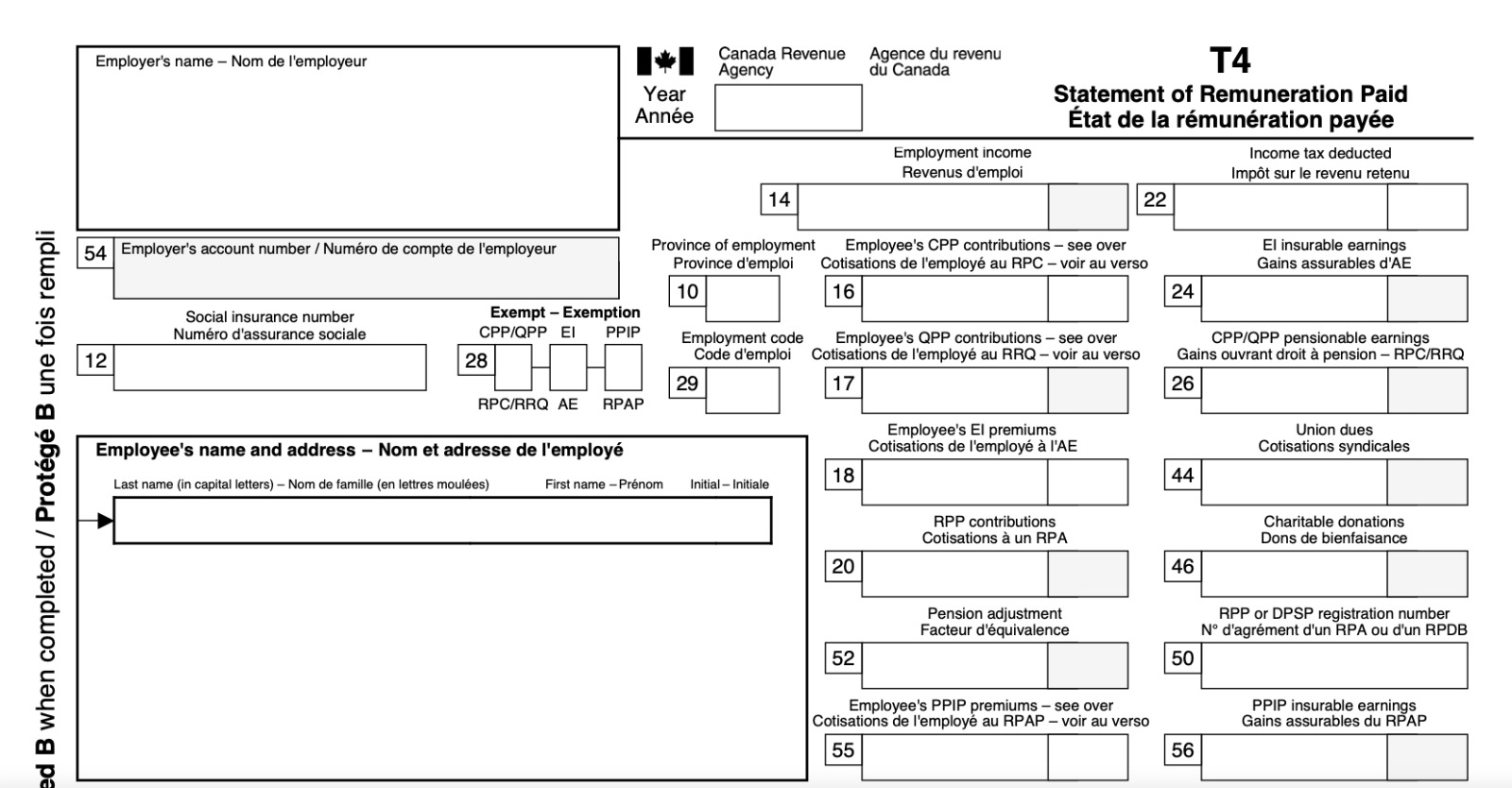

But in Canada, you need to send a T4A slip that resembles similar features to that of the 1099-MISC. But now that you must deal with the CRA, you must fill in the T4S slip instead of the 1099-MISC. T4S is a CRA form that applies to the payment made to all the independent freelancers and contractors of that year.

T4S

However, if you hire freelancers or independent contractors from the US for your Canadian business, you must also get the 1099-MISC filled, as the IRS will not accept the T4S slip.

T4S slips are due to contractors and the CRA in February of the following year from the year you paid them. For example, if you have paid your contractors in 2023, these slips need to be filled by the contractors and then filed to the CRA on Wednesday, 28th February 2024.

What You Must Do Next!

Oshawa Bookkeeping can help you with all the processes mentioned above. They will process all your documentation, audit your financial status, sift through all the odds and obstacles, orientate them, store them in the digital bookkeeping software, and finally fill out the forms on your behalf to let you catch up on bookkeeping. Contact us today for a free 30-minute consultation by calling us at 647-447-2782. Alternatively, visit Oshawa Bookkeeping to book your schedule on Calendly at your convenience.